Retired, but still figuring it out

Tasha retired earlier than expected and now navigates a smaller fixed income while planning not just for herself, but for her husband’s future as well.

Technically retired

In rural South Mississippi, Tasha’s mornings still begin with a small moment of disbelief. “I wake up every day, and ask myself what I want to do. It’s a good feeling.”

She’s retired—but not in the way people often imagine. She will tell you that living on a farm means her days are full. Chickens get let out to roam and tucked in at night. Rabbits need checking on. Horses require daily care. “Oh yeah, we’re busy,” she said, laughing. Retirement didn’t slow life down so much as give her control over how it unfolds.

After 24 years of working at the United States Postal Service, Tasha retired earlier than she ever expected to. For years, retirement was something she barely considered. “When annual statements arrived, I’d skim past them. I was like, yeah, I’m not even going to make it that long,” she said. And then, suddenly, it wasn’t distant anymore.

When the option for early retirement appeared, Tasha didn’t immediately accept the offer. She did what she always does when faced with a big decision: she asked questions of her inner circle. “I called everybody I know to ask them what I should do,” she said. The advice she heard again and again was simple—if you can afford it, do it. Tasha looked at her finances, knew she’d have to move some things around, and decided to take the leap. “I told myself that I have got to make this work,” she said.

And so far, she has.

Balancing freedom and flexibility

But retirement, for Tasha, was never going to be about stopping entirely; it was about shifting and prioritizing. Her retirement check is smaller than her paycheck was, and that matters. It matters additionally because her husband doesn’t have employer-matched retirement savings to fall back on. (We find of those SaverLife members with retirement savings, 23% do not have employer-matched accounts.*) His future income will rely largely on Social Security. That reality means Tasha’s retirement isn’t just hers; it’s something they’re navigating together, figuring out how far it can stretch and what they need to do now to prepare for his.

She keeps her eyes open for ways to add flexibility and cushion, without giving up the freedom she worked so long to reach.

Some of that income comes from what’s already around her. She sells eggs to neighbors, keeping prices fair even when shortages sent costs soaring. “They were like $10 a dozen,” she said. “but I’m not charging people $10 a dozen.” She sells antiques and odd finds online too. “You’d be surprised what people buy,” she said. “VHS tapes and driftwood are coveted items.”

But one idea she keeps circling back to feels especially rooted in where she lives and has her considering what it would look like to become a gig worker. This is a common theme for many SaverLife members. We learned that amongst those that were retired, 60% of SaverLife members identified as micro-entrepreneurs.*

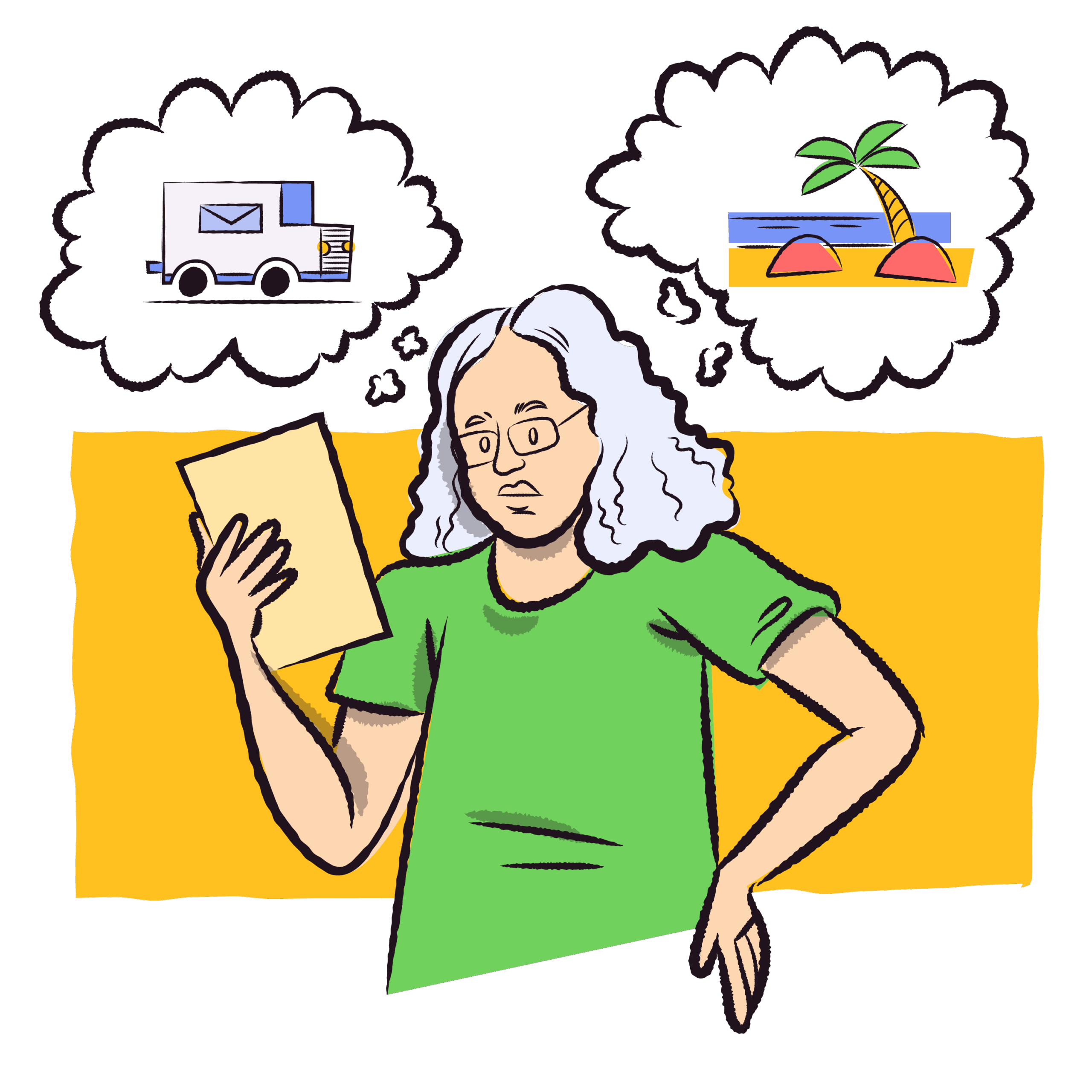

Not long ago, Walmart began offering deliveries out to her rural area—an option that makes sense when a single grocery run can take an entire day once travel is factored in. But for now, it comes with more questions than solutions.

A whole new world (and way of working)

Tasha says there’s a barrier to entry, and little guidance on how to get started with something so radically different from the job she held for 24 years. “I’m like, how do you even get that?” she said, thinking about the drivers who bring groceries out to places like hers.

The appeal is obvious to her. If she’s already headed into town, she could turn the app on, take a delivery or two, and help neighbors who don’t want to make the long drive themselves. “If I happen to go to town one day,” she said, “that’d be something I could do on the way home.” It feels practical and like the kind of work that fits retirement instead of replacing it.

What’s frustrating is that figuring out how to do it isn’t straightforward. “I’m still looking into it,” she shared. “I need to figure out where to sign up. What does it really pay? Is it worth the wear and tear on my vehicle?” That uncertainty mirrors retirement itself—there’s opportunity, but no clear instruction manual, especially when you are piecing things together and forging a new path.

Rising costs add another layer of complexity and consideration. “The electric bill,” Tasha said. “Groceries. Groceries have really, really gone up.” To manage that, she leans on habits she’s built over years: cooking from scratch, using what she already has, and resisting the urge to overspend just because something looks convenient. She’s also got a garden that works hard for her. “It helps a lot to grow your own food. I do a lot of canning and preserving,” she said. All of it requires careful planning which she has made into a daily practice.

That ability—to pause, assess what’s in front of her, and make something workable out of it—is the throughline in Tasha’s retirement.

She doesn’t talk about this chapter as an ending. She talks about it as something she’s building in real time, with flexibility, creativity, and a clear-eyed understanding of needing to weigh her options. She’s grateful for the freedom she’s gained, realistic about the trade-offs, and open to new ways of making it all add up—for both herself and her husband.

“So far, so good,” she said—and it sounds less like an ending than the quiet assurance of someone who trusts herself to keep figuring it out.

**(Survey data were collected online by SaverLife from over 1,400 of its member panelists in June 2025. Member panelists are SaverLife members who have agreed to participate in SaverLife research and were provided a financial incentive to participate in our research and storytelling efforts.)