Figuring it out

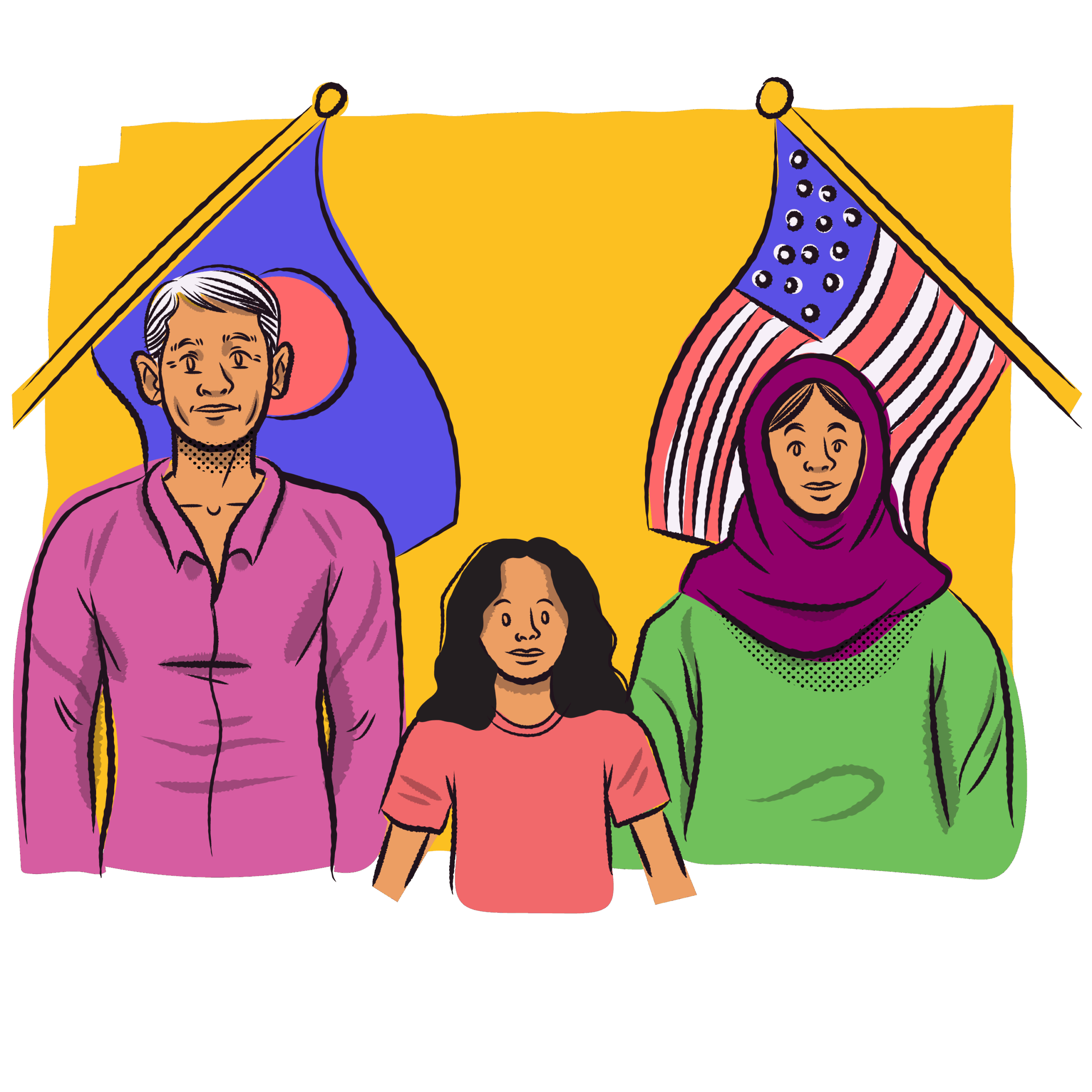

“I’m the oldest daughter, first in my family to go to college here,” she said. “My parents are immigrants from Bangladesh. They didn’t know anything about applying to colleges, loans—none of it. I literally had to figure it out on my own and even asked a friend’s dad, ‘What interest rate do I take?’ I just didn’t know.”

At 17, the stack of signatures and acronyms felt like a bridge to the future, not a bill for it. She enrolled at a private college, watched the bills pile up, and after freshman year made a hard pivot. “I came home and said, ‘I’m going to community college next year.’ It was so much cheaper, and I could work and save,” she said. Even then, the damage was done: loans—some private, some federal—followed her into adulthood. Thirty-eight percent of SaverLife members carry student loan debt, a reminder of how early financial decisions can echo for years.

“I don’t think I understood what I was signing up for,” she said. “Yes, the degree opened doors. I wouldn’t be where I am now without it. But the loans? They’re predatory. We’re talking about 18-year-olds trying to decode fine print.”

Career growth and financial progress

Today, Mahiyat works for an oncology nonprofit, coordinating the physician faculty who speak at major cancer conferences. It’s a role she stepped into after years of working with kids as a teacher and tutor—work that carried her through the early COVID years. “I completely shifted gears,” she said. “I’m still in nonprofit, just a different sector. I’m proud of the impact.”

The pride sits alongside a memory she can’t shake: watching interest quietly snowball. “A few years ago, my interest was $10 a day. Seventy dollars a week—gone,” she said. “Now it’s 77 cents a day. I did that.”

Trial, error, and persistence

How? Trial, error, and stubborn persistence. She downloaded her servicer’s app, learned how to target payments, and started making smaller, more frequent transfers. “Making multiple payments a month was a life changer,” she said. “Targeting principal lowered the balance, which lowered the interest. I mapped it out—every three or four days, another payment. Twenty dollars, fifty, a hundred. It adds up.” Over time, she knocked out two smaller loans and now has “about $3,500 to $3,600” left on her private loans. “Every time I see that daily interest drop, I feel like, I did that,” she said. “I had to figure it out on my own.”

And at the same time, Mahiyat is frustrated by the limitations that feel intended to keep her treading water. She found herself running into limits she didn’t know existed. “My loan servicer only lets me make a certain number of payments a month,” she said. “It’s so frustrating because I finally figured out a system that worked for me—making smaller, more frequent payments—but it’s capped. It feels like they don’t want you to get ahead.”

Family obligations and spending costs

Money, for Mahiyat, is practical and deeply emotional—tangled up with family and culture. She lives with her parents in Northern Virginia and helps when surprise costs hit: a water heater, car insurance, house repairs. “It’s an immigrant-kid thing,” she said. “My dad worked his whole life and has little savings. I don’t want that for myself or my future kids. So I help where I can.”

What she doesn’t do is follow a traditional budget. “I’m not a huge saver in the day-to-day rules sense,” she said with a laugh. “If something comes up and it’s not thousands of dollars, I’ll probably do it. Life is short. Money is there to be spent. If I say yes to a big thing, I know it means I’m going to work more hours.”

That’s where the side hustle comes in. DoorDash became her on-demand lever during COVID and again recently. “Some weeks it’s slow, some orders I turn down,” she said. “But even $20 in an evening offsets what I spent that day. It gives me a little sense of control.” Her experience reflects a broader pattern among SaverLife members: in 2025, 39% engaged in some form of microentrepreneurship, and about one in five of them earned extra money through side hustles.

She pays off her credit card every month—“I don’t ever keep a balance”—and uses cashback to squeeze a bit more out of ordinary spending. When a big expense or a meaningful trip appears, she doesn’t shame herself; she takes the trip but makes a mental note to be more conscious of her spending in the near future.

There’s a steadiness to the way she holds two truths at once: her degree is both a blessing and a bill. “I hate that I know so much about interest and amortization,” she said. “But knowledge is power. I don’t believe in gatekeeping any of this. It feels like us against these systems that count on people not knowing.”

If she could talk to her 17-year-old self, she knows what she’d say. “Community college first. Work and save. Learn the difference between subsidized and unsubsidized. Ask a million questions,” she said. “And if you do take loans, make small, frequent, targeted payments. You deserve a future that isn’t weighed down.”

Mahiyat’s life now is a string of thoughtful choices rather than strict rules: helping her parents when they need it; saying yes to experiences that matter; turning on DoorDash to fill gaps; showing up to a job that advances cancer care; and steadily dialing down debt that once felt immovable.

“I’m grateful I can live the way I do and still see that balance drop,” she said. “I’m proud of myself. I wish someone had told teenage me all this—but I can be that person for someone else now.”

Read more member stories

Discover how SaverLife members across the country are stepping up to protect their families and communities from the impacts of climate change.