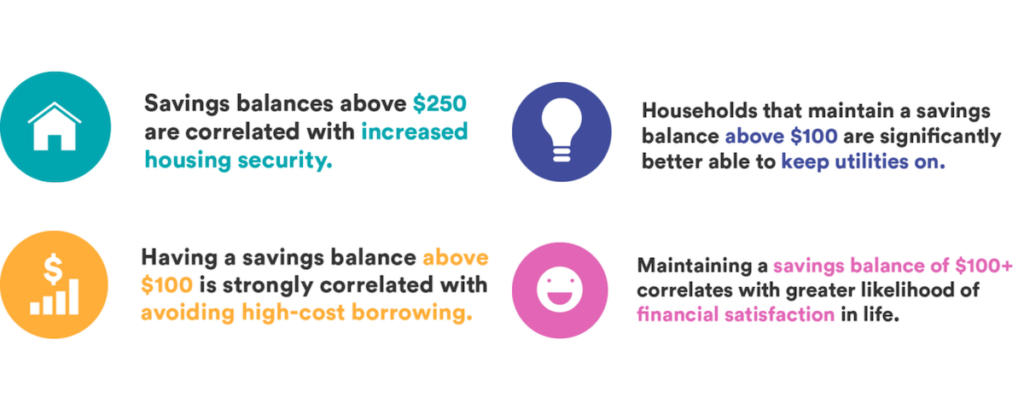

In our latest research, we discovered that having as little in savings as $250 made a huge difference in helping people keep the lights on, stay in their homes, and avoid taking on high-cost debt. We all want to aim for 3-6 months of savings but right now at least saving $250 may still help.

- Staying in your home: People with balances above $250 are 71% less likely to have to move for financial reasons

- Avoiding high-cost debt: People with balances above $100 are 83% less likely to need to avoid things like payday loans, auto-title lending, rent-to-own, and pawn shops

- Keeping the lights on: People with balances above $100 are 95% less likely to have their utilities shut off

- Feeling less financially stressed: People with balances above $100 have a 61% greater likelihood of financial satisfaction

If you’re looking to boost your emergency fund, here are a few resources you may find helpful:

- Help if you’re struggling to pay your bills during the COVID-19 crisis

- What to do if you have a lot of debt

- 6 steps to create the perfect budget

- Deciding whether to rent or buy a home