The Saver’s Credit: Are You Double Dipping on Tax Savings?

How Do Tax-Advantaged Accounts Work?

When you contribute to a retirement account like an Individual Retirement Arrangement (IRA) or a qualified employer-sponsored retirement plan (like a 401K), you receive a tax advantage. If the account is a traditional account, you may be able to reduce your taxable income for the current year. However, you’ll pay taxes when you withdraw them in retirement. If the account is a Roth, you won’t be taxed on those funds when you withdraw them in retirement. Both types of accounts can grow tax free. And for both accounts, withdrawing funds “early” (before retirement if they aren’t qualified withdrawals) can result in a tax penalty.

The tax advantages of these accounts can really be helpful in building up money for retirement. Which of these accounts is best for you depends on your specific tax and income situation, and your personal preferences.

What is the Retirement Savings Contribution Credit?

For some of us, we can actually double dip on tax savings for retirement. Not only can we get the tax advantages, but we can get the Saver’s Credit as well. This credit is called the “Retirement Savings Contributions Credit.” It’s designed to encourage people to invest money into retirement accounts. You may be able to take this credit for making eligible contributions to your IRA or employer-sponsored retirement plan.

See If You Qualify for the Retirement Savings Contribution Credit

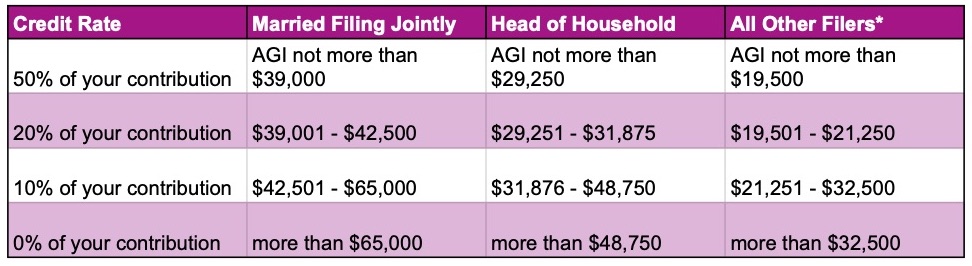

If you use tax software and contribute to an employer-sponsored retirement plan, it should be checking if you qualify. Just make sure you enter the letters and numbers from Box 12 of your W-2 in the software. The more money you earn, the less you get for this credit until it phases out entirely. The maximum credit is $2,000 for Married Filing Joint and $1,000 for all other filers. The maximum contribution that can be used in the calculation is $4,000 for Married Filing Jointly and $2,000 for all other filers. Whether or not you qualify is based on your Adjusted Gross Income, as shown in the chart below for tax year 2020. Also, you must be 18 years of age or older, not a student (generally speaking), and not someone else’s dependent.

2020 Retirement Savings Contribution Credit Amounts

*Single, married filing separately, or qualifying widow(er)

An Example of the Retirement Savings Contribution Credit

If you are single with an Adjusted Gross Income of $20,000 and you contributed $2,000 to your employer sponsored 401K, your credit would be 20% of $2,000. So you would receive a tax credit of $400. Please note that this credit is not refundable. This means if you’ve already reduced your tax liability to zero through deductions and other credits, you won’t receive the benefit of this credit.

There aren’t many opportunities for “double dipping” tax savings in our tax code. If you can take advantage of this one, it can help you improve your finances. But just like other credits and deductions that you may take, make sure that it fits both your financial and tax situation before investing to get this credit.