Sylvia’s Story: Home Ownership in the Future

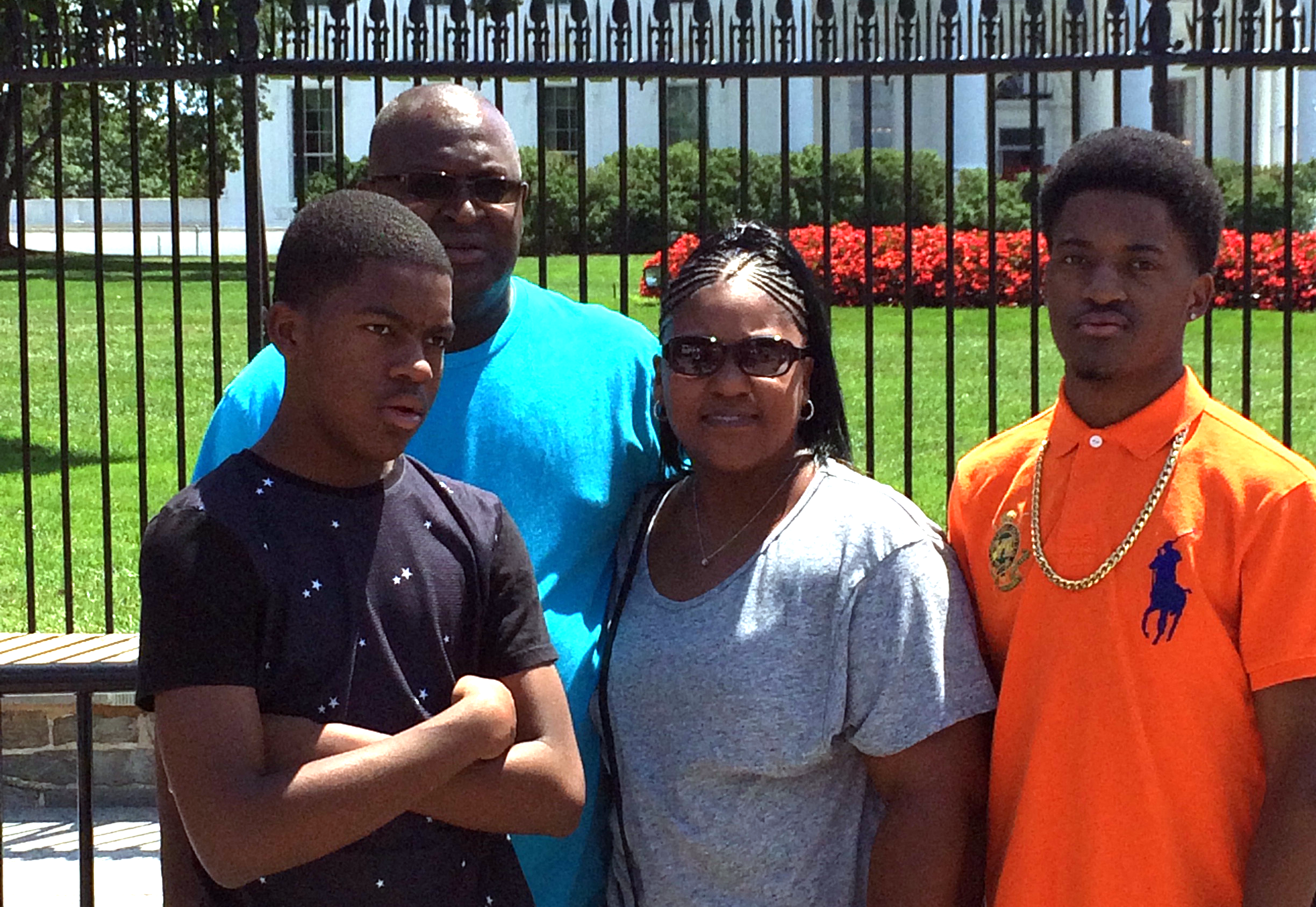

Meet Sylvia, an HR Manager for the Clark County School District in Nevada. She’s a Las Vegas native who lives with her husband and two adult sons.

What did your upbringing teach you about finances?

Nothing! That’s why I’m in debt now. I don’t think I was ever taught how to save or how important your credit score was. Really, what I learned from my parents was how easy it is to come into debt. Saving money wasn’t a conversation in our household growing up.

What have been the highest and lowest financial points in your life?

As far as accumulating credit card debt, I’m working on paying off the smallest amount then moving on to the next one. I want to get credit card debt out of the way to boost my credit score, and then I can focus on other things like owning my own home.

I’m also deep in debt with student loans that I’ve been paying off for who knows how long. Actually, I’m still finishing school. In December, I’ll be done with my master’s program in human resource management.

I’ve grown in my work. Career wise, I’m moving in the right direction. Hopefully, I’ll get a better job or promotion. At my current job, we haven’t had raises in nine years or increases in salary based on cost of living. To keep losing money isn’t feasible, you know?

What’s the best piece of financial advice you’ve received?

Save money regardless of how much you earn. Make sure you’re putting something aside.

What are your goals for the future?

I want to pay off my debt and become a homeowner. In five years, hopefully I’m where I need to be.

What does money mean to you in your life?

You need it to live, but I take it day by day. You need it for the things you want.