How much should I save monthly if I am in debt? Or what percentage of my income should I save if I am in debt?

Submitted by LaTisha V.

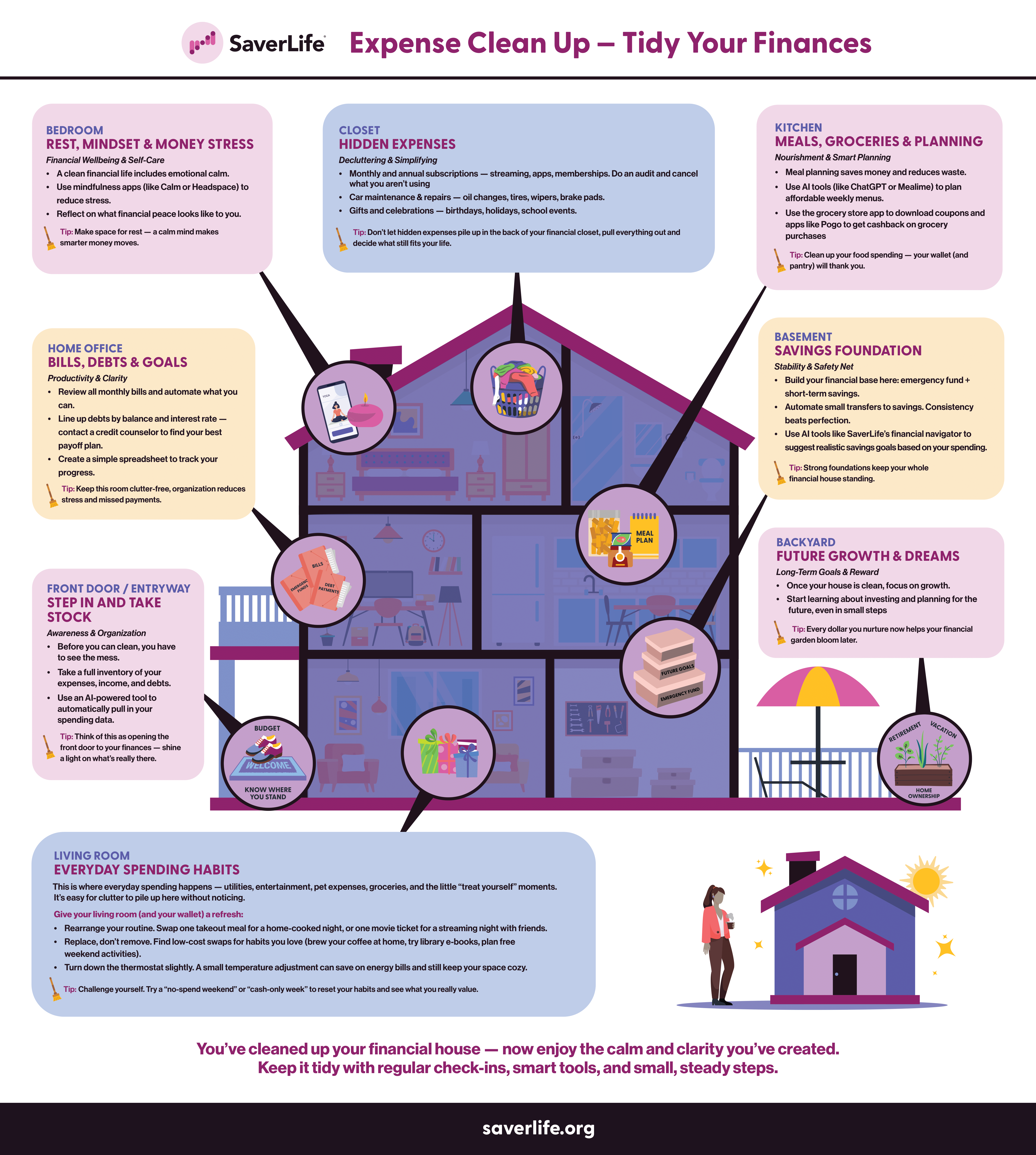

When we have debt, our priorities can change completely. To start, we have to remember that not paying our debt will negatively impact our credit history and therefore take away other opportunities in the future. In your situation, your income not only needs to cover your basic needs, but also your monthly debt payments. This means your savings capability will be reduced. However, this does not mean that it totally disappears. Saving is (almost always) possible.

Let’s start with the fact that there is no such thing as an ideal distribution of our income. Our needs are subjective and therefore we cannot answer this question with a mathematical formula. We all earn different amounts, we have different consumption habits, and our preferences change all the time. Even though experts recommend that we should aim to save 10% of our monthly income, you need to adapt this rule to your lifestyle. If you can do more, that’s great! On the other hand, if you can only save a few dollars a month, that is also great!

Anything you can save is better than nothing. You can always start with something small and grow from there. Saving is more about consistency than quantity. Get in the habit and the numbers will follow. And if you have debt and your savings capability is diminished, it’s good to remember that the money you use to pay your debt can eventually be reallocated to savings once your debt is repaid.

So, how do you see your panorama now? Are your savings goals realistic? Or do you have to change them? How much can you start saving today? Everyone must find their own financial balance.