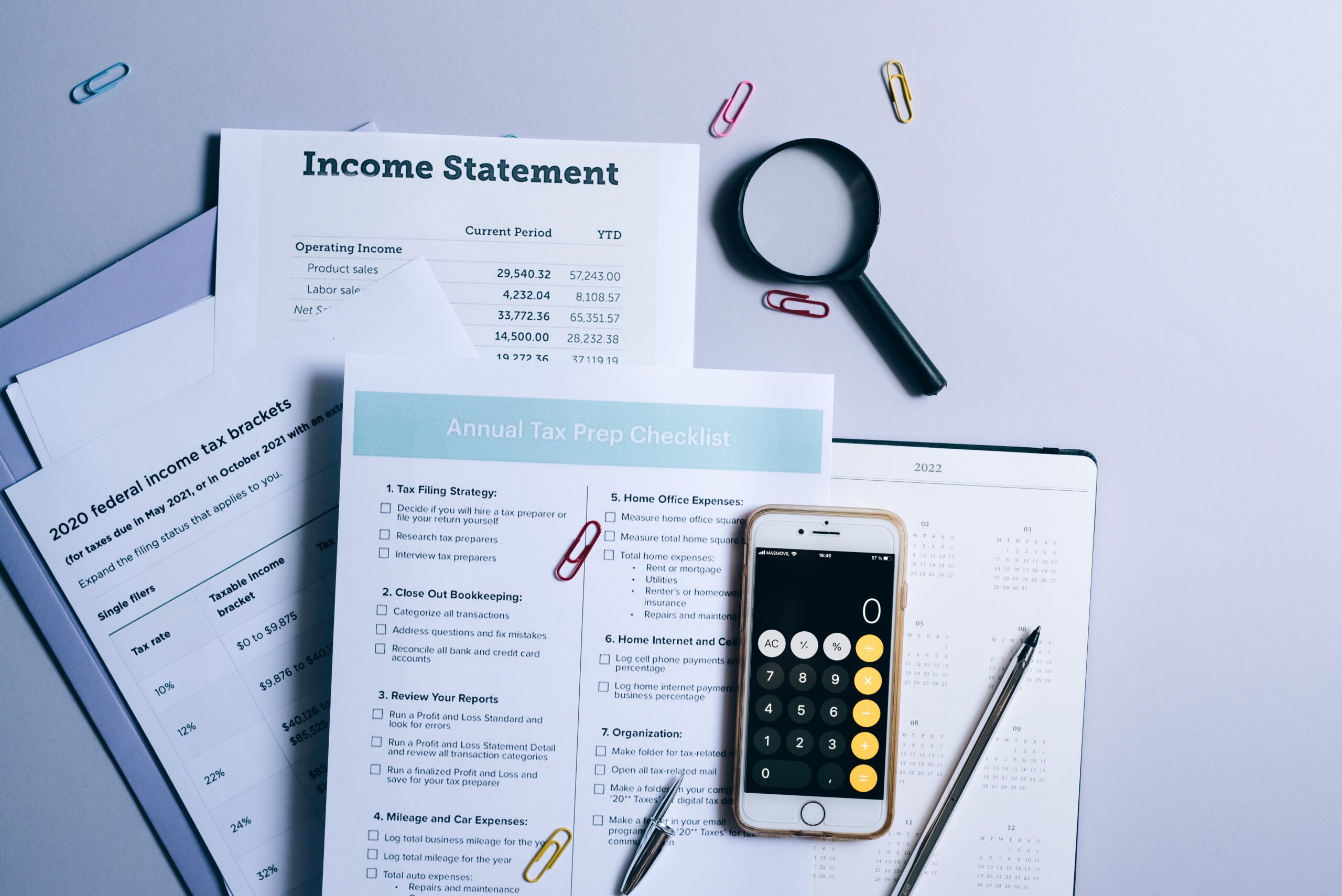

2024 Tax Time Guide

This tax season, we want to make sure you receive every dollar you deserve.

That’s why we’re sharing tax filing resources that are 100% FREE. Browse our guide to master tax time and make it your bonus season.

Tax Time Activities

We’re giving out $15,000 in cash rewards for tax time saving activities!

You have 3 ways to win:

1) Tax Time Pledge

We’re giving away $10 to 60+ SaverLife members weekly through 3/31! Pledge to save any portion of your tax return, and you’ll be entered to win.

2) Savings Challenge

Starting 2/19, we’re giving away $7,500 to linked members who opt into the Save Your Refund Challenge and save $150 by 3/31.

3) Activity Points

Earn 700+ points by finishing all Tax Time Activities – enough to buy THREE scratchers, which means you could win another $15!

Tax Time Resources

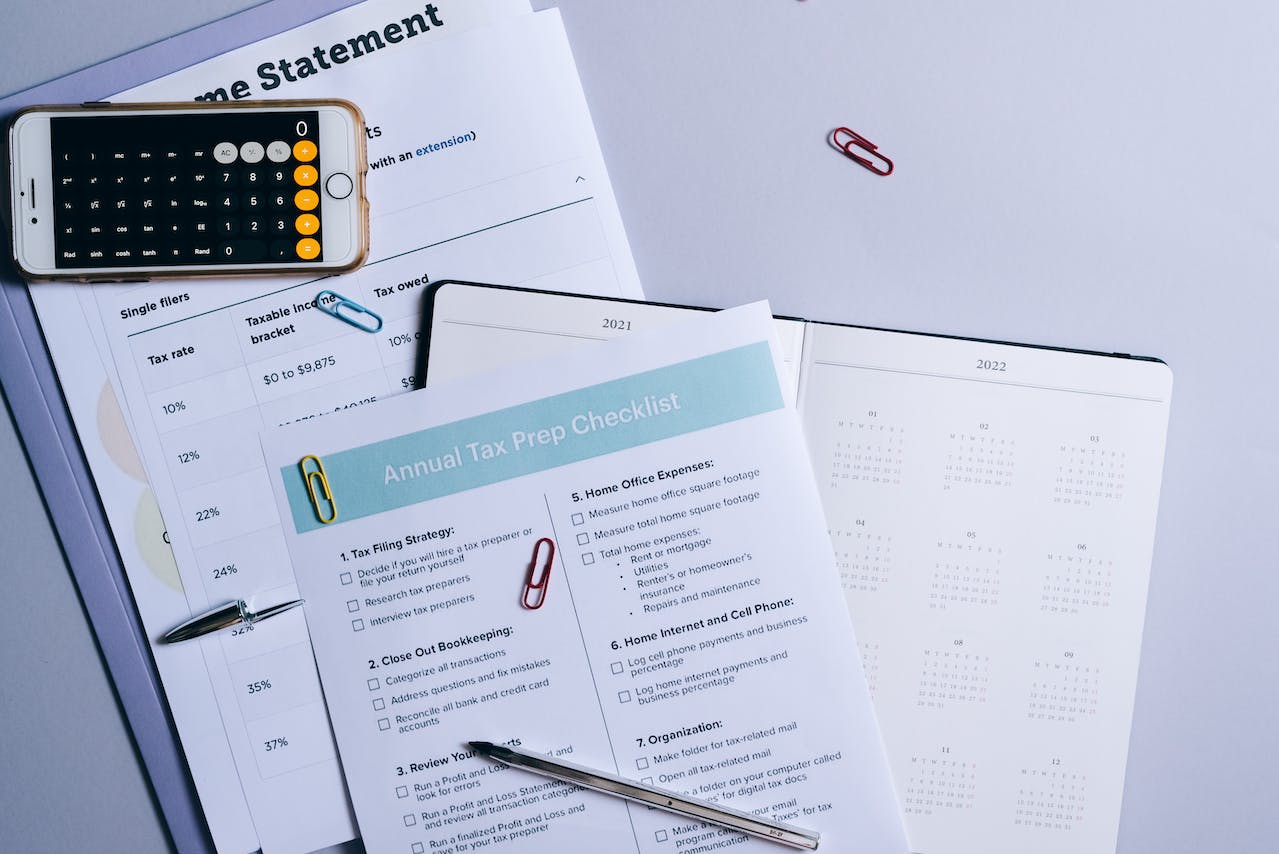

- January 12, 2024 – IRS Free File will be available on IRS.gov

- January 29, 2024 – The IRS will start processing tax returns

- April 15, 2024 – Deadline to file your federal tax return

- 1099-K Reporting Update – The IRS delayed the new $600 Form 1099-K reporting threshold for calendar year 2023. As a result, reporting will not be required unless you receive over $20,000 and have 200+ transactions in 2023.

- Pending Tax Legislation Could Affect Your 2023 Child Tax Credit (CTC)

The IRS’s Direct File pilot offers a new choice to file your 2023 federal tax return online.

If you’re debating whether to get a gas-powered vehicle or switch to an electric vehicle (EV), there are some ways you can save on both the cost of an EV and the cost to charge and maintain it. Read More >

Did you know the IRS offers multiple online resources to simplify tax season and help you maximize your refund. Read More >

With taxes come tax scams, and it’s important to stay informed on what these scams look like so you can protect yourself. Read More >

Did you know the IRS offers credits and rebates for improving the energy efficiency of your home? That means you could reduce the income tax you owe and maybe even qualify for a 50-100% rebate for energy-efficient improvements to your home. Read More >

Proposed legislation called the Tax Relief for American Families and Workers Act of 2024 has bipartisan support and could mean changes for the Child Tax Credit (CTC) and other business tax codes.

Are you missing out on tax credits that could increase your tax refund? Explore some tax credits you may not have heard about or haven’t considered using to maximum benefit. Read More >

The IRS has worked over the past few years to make tax filing easier and more accessible. Find out how the IRS expansion benefits you. Read More >

Make sure you’re ready to file your tax returns ASAP. Filing as soon as possible will help you get your refund as quickly as possible AND it’ll help prevent tax identity thieves from filing using your info. Read More >

Stay alert this tax season with the IRS’s list of the Dirty Dozen tax scams. Our infographic quickly summaries the schemes to watchout for this tax season. Read More >

The EITC is a benefit for working people with low to moderate income. If you’re eligible, you may receive thousands of dollars depending on certain criteria like your income, filing status, and dependents. Find out if you’re eligible to claim this tax credit.

Waiting for a tax refund can be frustrating. Did you know there are things you can do to help speed up the process? Read More >

We all want accurate tax preparation, reasonable prices, and good service. But with so many options available, it can be difficult to choose. So let’s go over some tips. Read More >

Our tax code is complicated, but only a small portion applies to most of us. In this article, we’ll help you understand when you can file taxes yourself online and when you need to get help from a professional. Read More >

The IRS sends many types of letters. Some IRS letters don’t require any action on your part while other letters do require action and have deadlines. Find out what you need to do when you receive an IRS letter.Read More >

5 DIY Tips for filing your taxes online ➜

What Should I do with an IRS Letter? ➜

How to fix your tax return after making a tax filing mistake ➜

The 4 Most Common Tax Errors You Should Watch Out For ➜

Once you started a small business or become a gig worker, taxes can become more complicated. The learning curve can be steep, but these tips will help you avoid the most common mistakes.

When you’re juggling a full-time job and launching your small business, taxes become more difficult. These 7 tips will help you navigate filing your taxes when you add a 1099 to the mix. Read More >

Is it possible you could be writing off more as a small business owner or gig worker? These 5 often overlooked write-offs may surprise you. Read More >

Creating a small business can be overwhelming, but we’re here to help! We’ve curated a list of small business resources covering topics like financing, human resources, planning and operations, taxes, and more. Read More >

Whether you’re starting a small business or trying to grow one you’ve already built, you may need outside funding. The prospect of applying for funding can be intimidating, but we’ve got you! The first step is simply preparing all your documents and records.Read More >

You Could Quality for FREE Tax Filing Help

Tax Time Allies connects you with IRS-certified volunteers who provide free help with basic income tax return preparation to qualified individuals through the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs.

GetYourRefund.org provides free tax prep services to families earning less than $66,000 a year. Trained, IRS-certified volunteers will help you prepare and double-check your tax return before filing. These volunteers can also help you file for previous years and make sure you receive tax credits you qualify for.

Stay Alert for Fraud & Scams During Tax Time

Many people receive a lot of money in their tax refund. Unfortunately, scammers know this and often try to take advantage of people during this time. It’s important to be vigilant and know what to expect during tax time so you stay one step ahead.

Be extremely careful about what you share on social media related to your taxes, and make sure you’re going to official sources like the IRS website to get information.

Avoid tax scams and overcome identity theft this tax season ➜

Already Filed? Check the Status of Your Refund

Check the status of your refund using Where’s My Refund and the IRS2go app.

NO PURCHASE NECESSARY TO ENTER OR WIN. A PURCHASE WILL NOT INCREASE YOUR CHANCES OF WINNING. Open to legal residents of the 50 United States (D.C.), 18 years of age and older. Void where prohibited. Promotion begins on or around 5:00 pm PT on 1/8/24 and ends at 4:59:59 pm PT on 3/31/24. For Official Rules, prize descriptions, odds disclosures, alternate methods of Sweepstakes entry, & all details, visit https://www.saverlife.org/official_rules/tax-time-2024. Sponsor: Earn Inc, dba SaverLife, 548 Market Street, PMB 46387, San Francisco, CA 94104.