Build Back Better Ensures Investment in Families

In July, we witnessed a new chapter in our country’s history. Direct payments of the Child Tax Credit (CTC) reached millions of families across the country and help was on the way for families with children who were struggling to pay for groceries, rent, or utilities, build rainy day funds, afford child care, and meet many other needs.

Here at SaverLife, we see firsthand what a difference the expanded CTC makes. The families we work with every day tell us how the expanded CTC means more food on the table, help with childcare, and the ability to save for the future. We see how enhanced tax credits lead to better financial outcomes for families.

“I was able to afford new clothes for my daughter when she started kindergarten. Having the payments now… has helped a lot with paying for childcare which is super expensive.” — Rhiannon, OH

This is why we celebrate the Build Back Better framework: a promise of much-needed investment in American families. Well before the pandemic, low- to moderate-income households were waging an uphill battle against poverty and inequality—especially Black and brown families, who have historically been overlooked and underserved. The Build Back Better framework expands the CTC for another year—and permanent refundability means that the lowest income families will still receive the CTC, lifting up millions.

“The expansion of the Child Tax Credit (CTC) is the most effective, poverty-fighting effort the federal government has launched in a long time.” — Leigh Phillips, CEO and President of SaverLife

LOOKING TO THE FUTURE

That’s why we won’t stop fighting. At SaverLife, we believe that all children deserve a strong start and that investing in families means investing in the future. While this one-year expansion to the Child Tax Credit represents a victory for children and families nationwide, there remains much to be done.

SaverLife will continue to advocate for the following:

- Making the Child Tax Credit expansion permanent

- Ensuring every family that’s eligible for the Child Tax Credit receives it in a timely manner

- Supporting the eligibility of families with mixed tax filing statuses (SSN/ITIN holders)

Earlier this summer, we developed a four-part approach to guide our work on the Child Tax Credit. As we continue our advocacy, we remain committed to:

- Ensuring Access – Making sure all families are receiving these monthly, advanced tax credit payments or know how to receive these critical funds

- Encouraging Savings – Highlighting the importance of preparing financially for the future and using this opportunity to encourage our members to save part of their payments

- Evaluating Impact – Gaining a deep understanding of how families are using the Child Tax Credit, through interviews, surveys, and analysis of bank account data

- Informing Stakeholders – Sharing testimonies from parents as well as proposals for better processes and rollout of the Child Tax Credit in the years to come

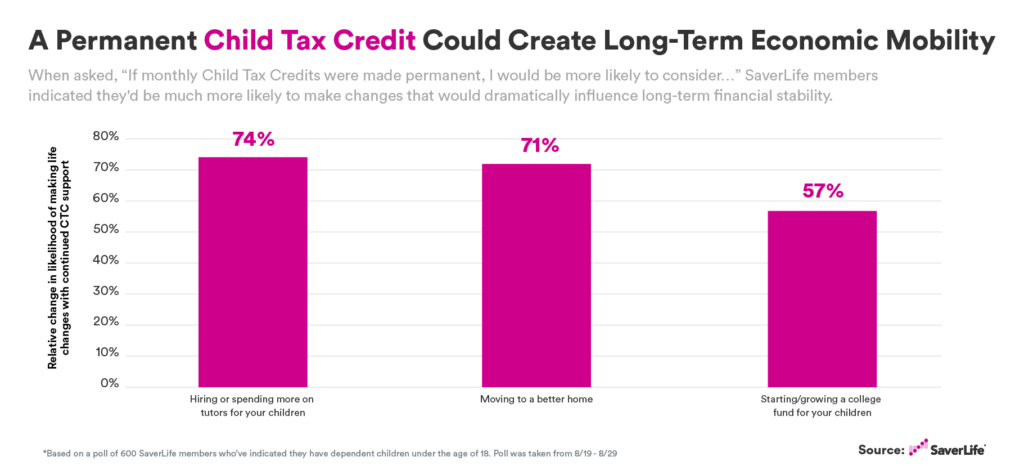

Lastly, we’d like to highlight the long-term impact the Child Tax Credit expansion could have. Almost 75% of parents would choose to invest in their kids’ education if the Child Tax Credit expansion were permanent, building a foundation for economic mobility.

We hope you will join us in 2022 as we continue to advocate for making the expanded Child Tax Credit permanent.